Is My Credit Score Useful Outside the US?

May 18, 2025 By Kelly Walker

If you've ever taken the time to check your credit score, you know it's an important aspect of managing your finances. But what if you are located outside the United States - is a US-based credit score still useful?

The short answer is yes, but there is more to consider when determining the effectiveness and advantages of utilizing a US-based credit score in other countries.

In this blog post, we'll explore how a US-based credit score can be applied abroad and guide you on taking advantage of it in different locations worldwide.

Is My Credit Score Useful Outside the US?

Yes, your credit score can be used to apply for loans and services outside of the US. Some lenders in other countries may even consider your US-based credit score when evaluating your repayability.

For example, banks in Canada will often consider a US-based FICO score as part of their lending criteria when you apply for a loan.

What Is a Credit Score, and How Does It Work in the US?

A credit score is a numerical representation of your creditworthiness and how likely you are to repay debt. It's based on the information in your credit report, which includes your history of borrowing money, such as loans and credit cards.

The higher your score, the better it is for lenders who want to extend your credit or loan products.

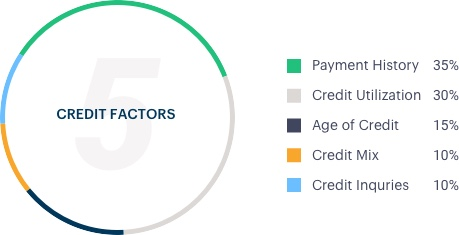

What Factors Affect a Credit Score:

Many factors affect your credit scores, such as payment history, amounts owed, length of credit history, and types of credit used. Payment history is the most important factor and accounts for 35% of your FICO® Score, so ensuring you pay all bills on time is important.

Amounts owed also affect your score and account for 30%, so paying off any outstanding debt and maintaining low balances on credit cards is important.

The length of your credit history is also considered (15%), as well as the types of credit you have used (10%). It’s important to manage these factors to maintain a good credit score.

How Can You Get Your Credit Score Outside the US?

If you live outside of the US, there are a few options for determining your credit score. One popular option is to use a non-US credit reporting agency such as Equifax Canada or Experian UK. These companies provide services similar to those offered by US credit bureaus, allowing you to get access to your credit report and score.

Other options include using services such as Credit Sesame or Credit Karma, both available in several countries, including Canada and the UK. Finally, you can get your credit score through a bank or lender if they offer such services. It's important to research what options are available and how to use them before relying on any particular method.

What Are the Benefits of Having a Good Credit Score Internationally?

A good credit score is essential for access to more favorable lending terms, such as lower interest rates and larger loan amounts. This can be especially beneficial when applying for financing from international lenders.

A high credit score makes opening a bank account in another country easier, allowing you to take advantage of better banking services and opportunities abroad.

What Factors Impact Your Credit Score in Other Countries?

The factors affecting credit scores in other countries may vary depending on the country and its specific credit scoring systems. Generally, however, some common factors that could impact your credit score include payment history (how you pay off debt), amount of available credit used, length of your credit history, types of accounts you have open, new inquiries into your credit, and public records such as bankruptcies.

Depending on the country, other factors may be considered, such as income levels, job stability, and even utility bills. Each of these components can help lenders decide whether you’re a good credit risk or not.

Tips for Improving Your Global Credit Score:

Credit scores can be improved by taking proactive steps toward managing your credit. Here are five tips to help you get started:

1. Pay bills on time: Make sure all payments, including rent and utility bills, are made on time monthly. Late payments will negatively affect your credit score.

2. Check credit reports regularly: Check your credit report regularly to make sure that the information is accurate and up-to-date. Incorrect or outdated information can harm your score.

3. Keep balances low: Keep your outstanding balances as low as possible to ensure you stay within your credit limit. The lower your balance is, the better it will be for your score.

4. Monitor credit applications: Be careful when applying for new credit cards or loans, as they can harm your score. Do the research and compare offers before committing to any debt contracts.

5. Seek help if needed: If you have difficulty managing your debt or understanding the credit system, don’t hesitate to seek professional help. A financial advisor or a credit counseling service can assist in getting your finances back on track.

How to Protect Yourself from Fraudulent Activity and Identity Theft Abroad?

It is important to remember that fraud and identity theft can occur anywhere, at any time. It is especially important to be extra cautious when traveling abroad. Here are some tips to help you protect yourself from fraudulent activity and identity theft:

- Use a credit or prepaid card instead of a debit card for purchases. Credit cards usually have better fraud protection and do not link directly to your bank account.

- Monitor your financial accounts closely and be aware of any unusual activity or transactions. Report any suspicious activity immediately.

- Keep a copy of all important documents, such as your passport, driver’s license, and credit card information, in a safe place when traveling.

- Ensure you use secure Wi-Fi networks when accessing the internet, especially for sensitive activities such as online banking or shopping.

- Use strong passwords and two-factor authentication whenever possible. Change your passwords regularly, and don’t use the same password for multiple accounts.

FAQs

How can I build my credit outside the US?

Depending on your location, there are different options for building your credit. For example, in the EU, you can use open banking services like N26, Holvi, and bunq to apply for a loan or credit card that helps build your credit score.

Can credit be used internationally?

Yes, your credit score can be used internationally. Many lenders outside the US use a different type of credit scoring system compatible with VantageScore, a US-based system.

Can credit be used internationally?

Yes, your credit score can be used internationally. Many lenders outside the US use a different type of credit scoring system compatible with VantageScore, a US-based system.

Conclusion

In conclusion, a US-based credit score can be beneficial even if you’re outside the United States. While it is not the only factor in building financial security and sound credit, it’s a reliable way to help you manage your finances.

By taking the steps outlined above, you can leverage a US-based credit score for use abroad and open up numerous opportunities that could improve your overall financial standing.

With all these advantages in mind, it’s definitely worth considering utilizing a US-based credit score if you’re outside the United States.

On this page

Is My Credit Score Useful Outside the US? What Is a Credit Score, and How Does It Work in the US? What Factors Affect a Credit Score: How Can You Get Your Credit Score Outside the US? What Are the Benefits of Having a Good Credit Score Internationally? Tips for Improving Your Global Credit Score: How to Protect Yourself from Fraudulent Activity and Identity Theft Abroad? FAQs How can I build my credit outside the US? Can credit be used internationally? Can credit be used internationally? Conclusion

10 Essential Steps to Prepare Your House for Sale

Steps to Making a Profit in Crude Oil Trading

Your Guide to Achieving and Maximizing an 800 Credit Score

Is My Credit Score Useful Outside the US?

Navigating Escrow Challenges in Real Estate Transactions

Understanding Tax Benefits

The Basics of Commodity Futures: A Beginner's Guide

12 Best Books on Warren Buffett

How to Prevent Foreclosure and Keep Your Home Secure

Lifespan of An Appraisal

What Does the S and P 500 Index Measure and How Is It Calculated?