Understanding the Tuition and Fees Tax Deduction

Sep 14, 2024 By Rick Novak

Education costs can be a tough financial weight, but the tuition and fees tax deduction might give some help to taxpayers. This deduction allows qualified people to reduce their taxable income by asserting particular expenses for education. In this article, we will walk you through various aspects of the tuition and fees tax deduction. We will also discuss eligibility criteria, what expenses qualify as deductible, how to claim it correctly, and other important factors you need to consider to get this benefit from your taxes.

Eligibility Requirements

To be able to get the tax deduction for tuition and fees, people who pay taxes must meet certain requirements that are established by the IRS (Internal Revenue Service). In general, those who can claim it need to be paying for qualified educational costs either for themselves, their spouse, or a dependent. The school they're attending should also be eligible and take part in federal student aid programs so that these expenses align with what the IRS deems acceptable.

Another thing to keep in mind is that the taxpayer needs to have paid for these expenses while they were attending an educational institution that qualifies for this deduction. Also, people must satisfy specific income limits to be eligible for the deduction. You can find more detailed information about what counts as a qualified expense and the rules around income thresholds on the IRS's official website.

- Income Thresholds: Taxpayers must be within specified income limits to qualify for the deduction. These limits are subject to change annually and may vary based on filing status.

- Dependency Status: Dependency status can affect eligibility. If a taxpayer claims someone as a dependent on their tax return, that dependent cannot claim the deduction for themselves.

Qualifying Educational Expenses

Deduction for education expense tax involves various costs that are eligible and connected to higher education. This can incorporate tuition fees, fees for enrollment, and other compulsory expenses related to being enrolled. Furthermore, these deductions may also be applied to expenses like books or supplies required by the course such as equipment needed for laboratory work etcetera. Nevertheless, costs such as room and board, transport, insurance, and non-academic fees are normally not eligible.

Another point is that what counts as qualifying expenses may differ based on the type of educational program and institution. For instance, expenses related to vocational training or continuing education courses might also be considered for the deduction. Individuals paying taxes should refer to IRS rules or ask an expert to find out if their particular costs are eligible.

- Professional Development Expenses: Certain professional development courses or certifications may qualify for the deduction if they are related to the taxpayer's current occupation.

- Educational Loans: Interest paid on student loans may not qualify for this deduction but could be eligible for other tax benefits, such as the student loan interest deduction.

Claiming the Deduction

Taxpayers have the right to make use of the tuition and fees tax deduction for their annual income tax return. To claim this, one should utilize Form 8917, Tuition and Fees Deduction, which is available from the Internal Revenue Service (IRS). It is crucial to report all applicable expenses correctly on this form, as well as adhere closely to instructions for maintaining adherence to tax regulations. Remember, this deduction is an adjustment to income. This shows that it's accessible for all taxpayers, even if they don't itemize their deductions.

While making the deduction, taxpayers must keep the necessary paperwork to confirm that they are eligible and have claimed valid expenses. This can consist of receipts, enrollment statements, and any related documents given by the educational establishment. Furthermore, taxpayers should go through IRS guidelines and Form 8917 instructions to prevent mistakes or possible hold-ups in handling their tax returns.

- Documentation Requirements: Taxpayers must maintain records of their qualifying educational expenses to support their deduction claim in case of an IRS audit.

- Electronic Filing: Taxpayers filing electronically should ensure they accurately input the deduction information into their tax preparation software or provide the necessary details to their tax preparer.

Limitations and Considerations

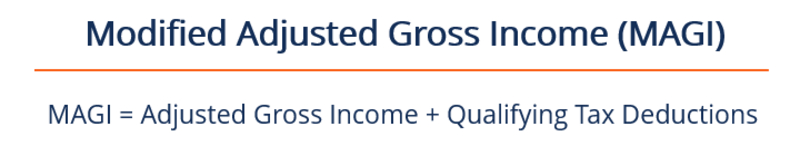

Even though the tax deduction for tuition and fees is beneficial, there are some things you should know before using it. The maximum amount of deduction can change every year because it depends on yearly adjustments. It might also differ based on how someone files their taxes and what their modified adjusted gross income (MAGI) is at that time. People cannot claim this type of deduction if they already claimed either the American Opportunity Tax Credit or Lifetime Learning Credit for a student in the same tax year.

It's wise for taxpayers to assess if they are qualified for other education-related tax credits and deductions, so they can get the greatest benefit from their tax savings. Remember, the tuition and fees tax deduction might alter because of modifications in legislation or IRS rules. Being aware of any alterations in tax laws can help taxpayers make smart choices about their educational expenses and planning for taxes.

- Other Education Tax Benefits: Taxpayers should compare the benefits of the tuition and fees tax deduction with other education-related tax credits and deductions, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.

- Legislative Changes: Taxpayers should stay informed about changes to tax laws that may impact the availability or eligibility criteria of the tuition and fees tax deduction.

Conclusion

As the cost of education continues to rise, the tuition and fees tax deduction remains a valuable opportunity for taxpayers to offset their educational expenses. By understanding the eligibility requirements, qualifying expenses, claiming procedures, and limitations of this deduction, individuals can take full advantage of the savings it offers. As you prepare your taxes, consider exploring whether you qualify for this deduction and consult with a tax professional for personalized guidance.

Take advantage of every opportunity to maximize your tax savings and secure your financial future. Ensuring compliance with IRS regulations and maximizing available tax benefits can significantly impact your financial well-being. Proper tax planning, including the utilization of education-related deductions and credits, can help alleviate the burden of educational expenses and contribute to long-term financial stability. Remember to keep accurate records of your expenses, stay informed about changes to tax laws, and seek professional advice when necessary. By taking proactive steps to optimize your tax situation, you can effectively manage your finances and achieve your educational and career goals.

10 Easy Post-Account Closure Steps To Secure Your Assets

Unlocking Six Best Free Checking Accounts

Understanding Tax Benefits

Exploring the Common Ways to Move Expense Claims for Returning to School

Understanding Estimated Taxes and the Dreaded Penalty: A Complete Guide

Companies Owned by Disney

Best Identity Theft Protection Services

Lifespan of An Appraisal

Renters Insurance Explained: Are Your Storage Units Protected?

Online Credit Unions: How To Join and How It Works

Ways to Live Frugally in Retirement